The Bond market is the largest securities market in the world. Bonds are units of corporate debt issued by corporations and government bodies to be used as tradable assets. A Bond is referred to as a fixed-income instrument that is traditionally paid a fixed interest rate to debtholders.

Security

Traditionally safer investment

Yield pickup

More predictable

Diversification

Hedge risk in your portfolio

Multiple markets

Wide variety of options

Offsetting

Ideal to offset volatility

Diversify your portfolio

A Bond is an OTC (Over-the-Counter) fixed-income debt instrument that technically is a loan from an investor to a company or government agency.

Let’s say a corporation decides to expand its product range and as a result requires capital raising to undertake research and development. The total R&D cost to get the product to market is 10 million dollars. In order to raise the capital it might decide to sell 10,000 Bonds to investors at $1,000 each.

LEARN TO TRADE BONDS CFDs

A Bond CFD is a form of derivative trading. When trading Bonds as a CFD, you are not purchasing the literal Bond, you are taking a position on the price of the underlying instrument in the market. Trading Bond CFDs allows you to take a long position (price rising) or a short position (price falling). Each Bond CFD uses a designated Bond as its reference point. CFD stands for “Contract for Difference” which ultimately means the difference between the opening and closing position of the Bond.

The MT5 platforms offered by Zero Markets are the ideal choice for trading Bonds CFDs.

Metatrader 5 (MT5)

MT5 are the favourite choice for Bonds traders around the globe. Zero Markets’ MT5 are packed with extras to ensure you’re equipped with all the tools you need to make better informed trading decisions. Tight Raw Pricing, fast execution and superior charts are the building blocks for our MT5 solutions.

BUYING BONDS

Opening Price

$100 × 10 contracts= $1000

Closing Price At $110 × 10 contracts = $1100Gross Profit on Trade $1100 – $1000 = $100

Closing Price At $90 x 10 contracts = $900Gross Loss on TRADE $900 – $1000 = -$100

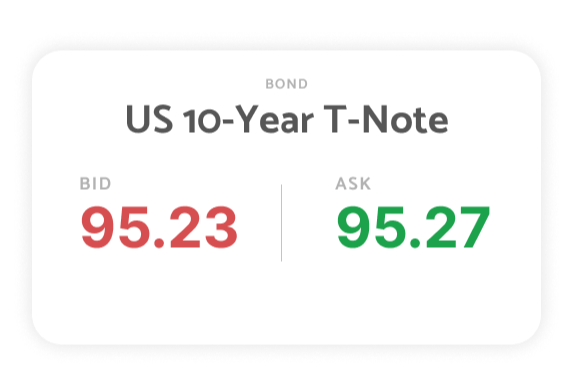

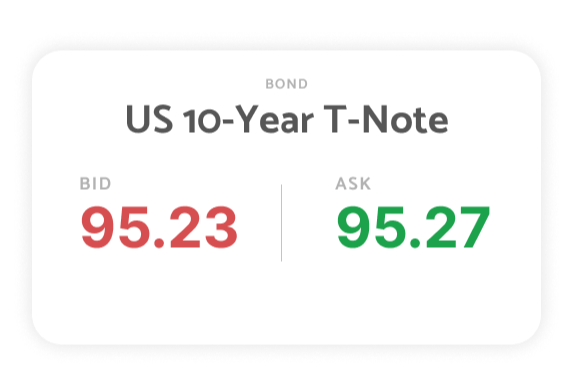

You believe that the price of the US 10-Year Treasury Note (US10YR) is likely to increase, so you buy 10 contracts at an ask price of $100.

3 weeks later, the price of the US10YR is now $110 (bid), an increase of $10 on your entry price. You decide to close your position and take profit, earning you $10 profit x 10 contracts = $100 total profit.

TRADE FROM 0.0 PIPS

| Standard account |

Super ZERO Account |

||||

|---|---|---|---|---|---|

| Symbol | PRODUCT DESCRIPTION | MIN | AVG | MIN | AVG |

| GILT | UK Long Gilt Futures | 0.43 | 0.43 | 0.43 | 0.43 |

| US10YR | US 10yr T-Note Futures | 0.44 | 0.47 | 0.44 | 0.47 |

Start trading Forex today

Licensed & Regulated

Research & Education

Technical Analysis Tools

Transparent Pricing

One-stop Destination

24/5 Live Support

Forex Webinars

Trade On The Go

Same Day Account Opening

Our dedicated team of customer support agents are on hand 24/5 to provide you with multilingual support. Contact Us

Visit our comprehensive FAQ where you can find information about the services we offer and answers to your trading questions. Help Centre

Stay on top of market trends and analysis by following us on social media and visiting our financial markets blog. Blog